Before diving into your home search, it’s crucial to understand the steps involved in securing a mortgage. Knowing these details can significantly impact your home buying experience.

In this article, we’ll break down two essential terms often confused by homebuyers: pre-qualification and pre-approval for a mortgage. While both are important steps in the home-buying process, they have key differences that can affect your success and how you approach your search.

What are Pre-Qualification and Pre-Approval?

Pre-Qualification: Pre-qualification is an initial step to estimate how much you might be able to borrow. This process involves a preliminary assessment based on the information you provide about your income, assets, and debts. It doesn’t require a thorough verification or credit check.

- Advantages of Pre-Qualification:

- Gives you a rough idea of the amount you could potentially finance.

- Quick and easy to obtain, often done through an online assessment or over the phone.

Use my app to get pre-qualified in just a few minutes, and start exploring your options today!

Pre-Approval: Pre-approval is a more detailed and formal process. It includes a full credit check and a thorough review of your financial documents, such as proof of income, assets, and debts. This gives you a clearer picture of your borrowing capacity.

- Advantages of Pre-Approval:

- Provides a more accurate figure of how much you can borrow.

- Shows sellers that you are a serious buyer, which can speed up the approval process.

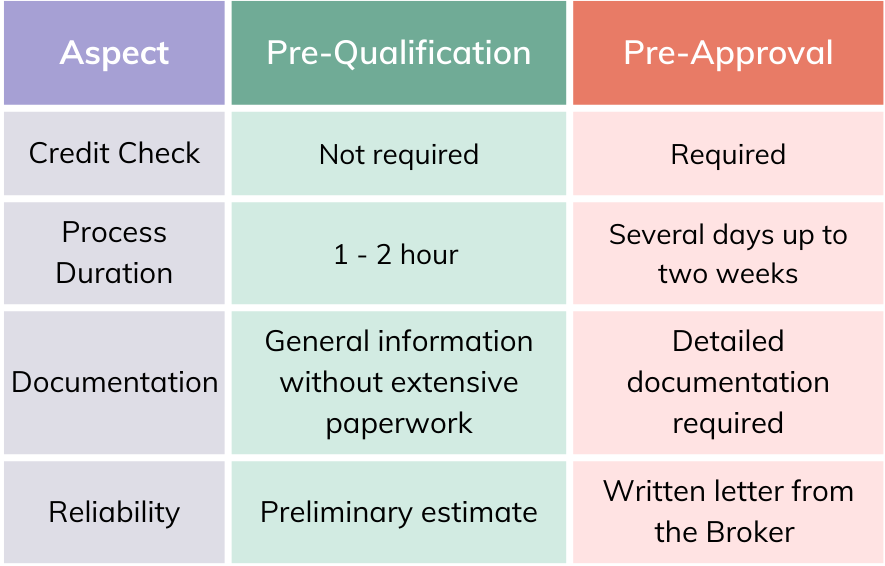

Comparison: Pre-Qualification vs. Pre-Approval

When Should You Get Pre-Qualification and Pre-Approval?

- Pre-Qualification: Best at the start of your home search to get a general idea of your budget.

- Pre-Approval: Recommended when you are more committed to buying. This provides a competitive edge in the market and is usually done within the 3 months leading up to your purchase.

Both pre-qualification and pre-approval are crucial steps in the home-buying journey. While pre-qualification offers an initial estimate, pre-approval provides a more precise and formal evaluation that can strengthen your offer and streamline the buying process.

Ready to take the next step toward your new home? Use my app for a quick pre-qualification, and when you’re ready, contact me for a personalized pre-approval. Let’s turn your homeownership dreams into reality!

Karla Badillo – Sherwood Mortgage Group Brokerage 12176